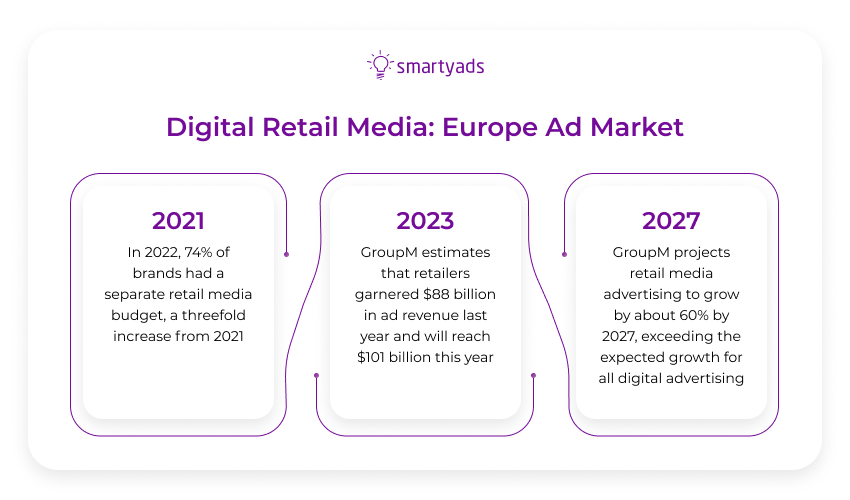

In 2023, retail media networks have become full-scale data-driven entities. They are New Publishers of the post-cookie world, offering advertisers and brands their inventory and expanding their boundaries through programmatic advertising.

Today, according to IAB research, 92% of European advertisers are already cooperating with retailers, and by 2026 retail media spending could be as high as $100 billion in the United States! It is a whole new profitable category of performance marketing.

Retail media networks still need interoperability for advertisers and brands, and common measurement standards. But they are the future. Let’s discover the reasons why retail media is receiving much attention today.

Insight into the Future

Looking ahead, all players in the advertising landscape are waiting for an era without third-party cookies. More than zero and standard first-party data is needed for full-scale marketing campaigns.

Retail media is a vast growth opportunity not only for direct sales but also for advertising technology. Specific user data from retailers is an excellent alternative to third-party cookies. Moreover, this data meets all privacy requirements. Therefore, it is unsurprising that brands and advertisers are increasingly partnering with retailers as new publishers. Retailers, in turn, get a very profitable new revenue stream as they invest in their growth and new technologies.

According to research by IAB Europe, today, 92% of advertisers and 74% of agencies are already cooperating with retail media:

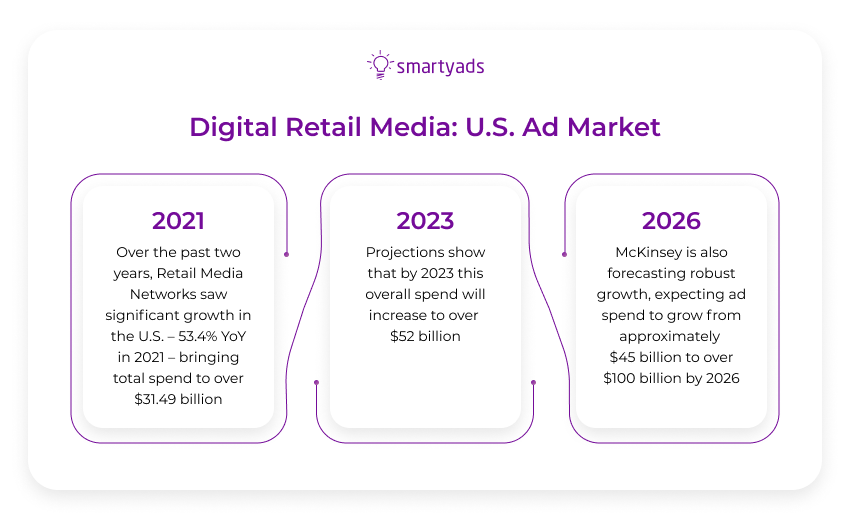

Retail Media Networks also showed growth in the U.S. Total spending is expected to reach more than $52 billion by 2023:

IAB Europe has even created a working group to provide information on the retail media landscape, new ideas, and standards. Changes are coming!

What are Retail Media?

Customers are becoming more demanding. By comparison, the recent delivery of goods within 4-6 days was considered comfortable. But nowadays, consumers want to get their new gadget or sweater right to their home quicker than a pizza.

Retail platforms, where you can choose a product, read about it, and order it immediately, are great for these tasks. These are Amazon, eBay, Walmart, and other marketplaces.

The following formats are most commonly used at major retail platforms:

- display & video ads;

- in-store advertising.

Retail media may consist of:

- featured product sections;

- related product sections;

- limited-time deals;

- platform search results.

In addition, mobile retargeting is a key strategy for retailers. For example, push notifications work great in remarketing. Let's say somebody looks at something at a retail site and puts it in the basket but doesn’t buy it. After a while, they can get a push notification about the forgotten purchase on their phone lock screen. Most online sales are made through smartphones, so suitable reminder ad formats are designed for this: pop-ups or messages.

All retail media formats are quite variable and convenient for automatic placement.

Evolution of the Customer Journey

For advertisers, retailers are becoming more valuable due to their sophisticated customer data and direct means of them.

Retail media is the fastest-growing advertising format today. Actually, it's both a marketing concept and a type of advertising. The primary purpose of using retail media in marketing campaigns is to increase the presence of your goods and impact the consumer directly at the point of sale.

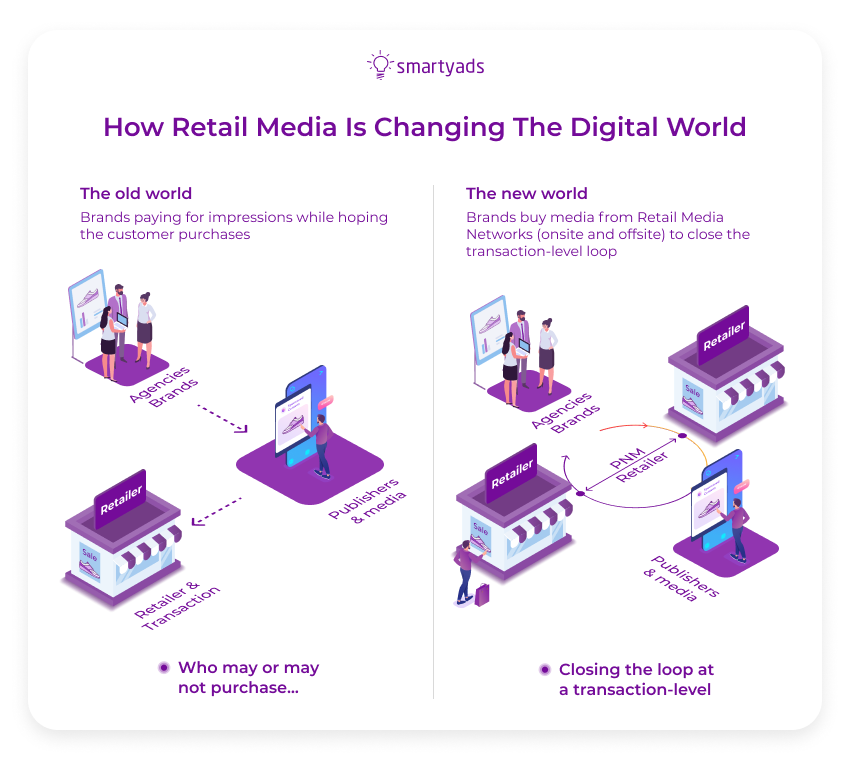

But nowadays, media is becoming retail, and retail is becoming more like media. Social network pages increasingly feature ads with an instant purchase button, and e-commerce sites feature full sponsored content. Retail platforms are attempting to move away from overly commercialized environments and are in serious competition with publishers.

It's all simple: the shorter the customer journey, the greater the likeability of sales conversion. And the more links and transitions there are to other sites, the worse it is for the user. Transforming media into retail and retail into media makes it possible to create a quick and comfortable format for brand interaction with a potential buyer. For instance, on Facebook, you can see more and more advertising for a product with a "buy" button, and on retail platforms; on Amazon, you can not only look at the photo of the product but also read an entire article with tips, video reviews, and life hacks.

The whole marketing funnel into one place. Convenient, isn't it?

Retail Media Platforms in the U.S.

Retail companies offer brands a retail media network (RMN). This advertising infrastructure includes a set of digital channels in the form of websites or applications. In other words, ads for the products of this brand will be shown simultaneously on all channels of the retailer's network:

Let's look at the biggest U.S. retail media platforms and what they offer today to agencies and brands:

- As one of the oldest big retailers, eBay has already gained fans worldwide. Today, it is actively adapting to the evolution of the digital world on a level playing field with other giants. eBay offers three types of ads: promoted listings, classified ads, and display ads;

- Up to 15% of all digital advertising spending between now and 2024 is expected to come from Amazon. They provide access to a large customer base. Amazon Ads can apply various formats like media ads, lists of advertised and sponsored products, and customize the appropriate targeting options;

- Walmart is slightly below Amazon in size but has more than 240 million customers worldwide. You can create targeted ads based on customer history and buying preferences here. You can also segment your audience to meet the needs of advertisers and even test your ad campaigns (A/B testing);

- Roundel offers an array of creative tools for advertisers and provides comprehensive reports on the effectiveness of advertising campaigns. They have sponsored products, onsite and offsite displays, Google search displays, and connected TV;

- Retail Media+ provides advertisers with tools like onsite and offsite advertising, also by email advertising;

- Wayfair also has a lot of users (over 72 million); it tracks and measures campaign effectiveness. They offer sponsored products, promotions, and onsite and offsite advertising;

- Kroger focuses on food and groceries. They use a special PromoteIQ tool to manage their advertising campaigns;

- Instacart is one of the most extensive shipping services in the U.S. They have a large reach of customers, including millennials;

- Best Buy offers a specialization in electronics. They offer advertisers advanced targeting and personalization as well as real-time analytics.

How precisely the market is divided between these giants can be seen from these marketing statistics.

Each retail media network has unique advertising opportunities, attribution, and measurement standards.

In recent years, in the U.S., there has been a diversification of retail media. In other words, there are new types of retail media. In addition to the extensive retail media networks like Walmart, Amazon, and Roundel, more niche ones like Wayfair and Home Depot emerged. Various connected media platforms from Criteo and CitrusAd also are gaining momentum.

New publishers: Advantages for Advertisers

Retailers are increasingly referred to as New Publishers. They sell their inventory already as a publisher, and that sale is already available programmatically. Let's look at the benefits of advertising in retail it's possible to get today by leveraging RMN in their campaigns.

Live Commerce

Working with retailers helps marketers focus on how brands are presented on gadgets.

The advanced capabilities of retail platforms influence the customer like never before. It's possible to show the goods in the best light, engaging as many sensory influences on the person as possible through video, photos, reviews, virtual reality, and more. The largest retailers already use a live commerce strategy.

Advertisers also can send a relevant message when the consumer is at the outlet. It is an excellent opportunity for marketers to communicate directly with consumers ready to buy.

First-Party Cookies

According to a study by the IAB, around 60% of marketers will turn to first-party cookies in the post-cookie era and search for suitable channels.

Retailers have digital platforms that are gradually open to various brands and advertisers. It is expected that they will unlock the great potential of primary user data in the near future. RMN is already developing strategies to leverage its accumulated customer data for the post-cookie era.

Marketing experts also believe retailers will likely sell their data to other advertising technology platforms. They can provide valuable data to help get through the apocalypse of the digital world.

Opportunities for Non-endemic Brands

Two types of brands that have entered into partnerships with retailers:

- Endemic brands that already sell their products and work with specific platform targeting tools;

- Non-endemic brands' cooperation with retail platforms is not convenient due to the nature of their product or service. For example, they are financial services or products that are not commonly ordered online.

Non-endemic brands also want to reach their audiences through retail media on the same platforms as endemic brands. They don’t sell their products on the same digital shelves that endemic brands do; they can use native and media ads on these platforms. It could be a travel ad on a page with suitcases or a video review of a small woman's car on a page of expensive cosmetics.

Closed-Loop Attribution

The other advantage of retail media platforms for advertisers is that they provide an analysis of real-world consumer behavior. This is possible due to the closed-loop attribution methodology to assess the impact of marketing channels and campaigns on closed sales.

It is through marketing attribution that marketers typically report their successes.

Because of their scale, the largest retailers create their own advertising technology based on first-party cookies. But these are more than full-fledged advertising ecosystems. Programmatic platforms are the link between marketers to create effective solutions for buying and selling inventory.

High-Precision Targeting

Today, retail media can facilitate more accurate targeting through its accumulated customer data. As a rule, retail media works based on primary data, search data, and product context.

Opportunities and Barriers

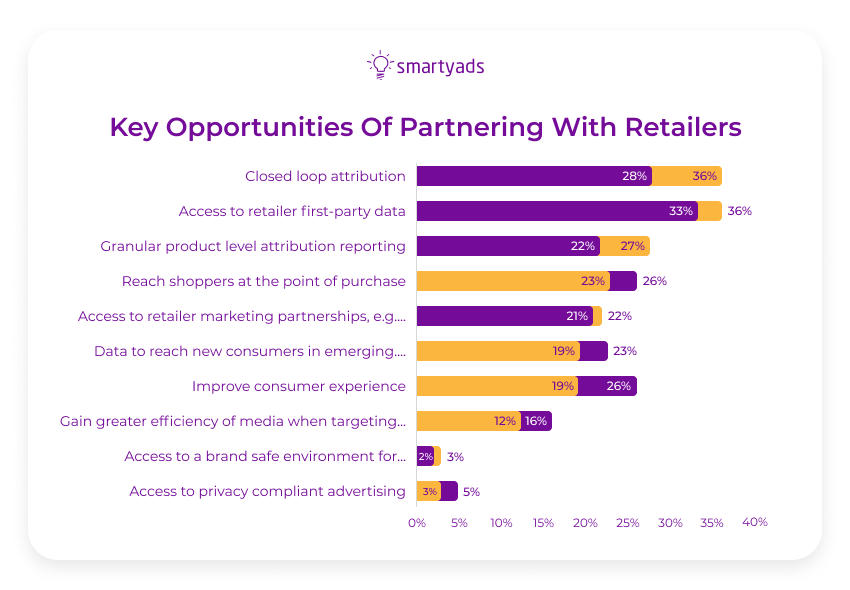

According to IAB research, agencies and advertisers are most attracted to such opportunities of partnering:

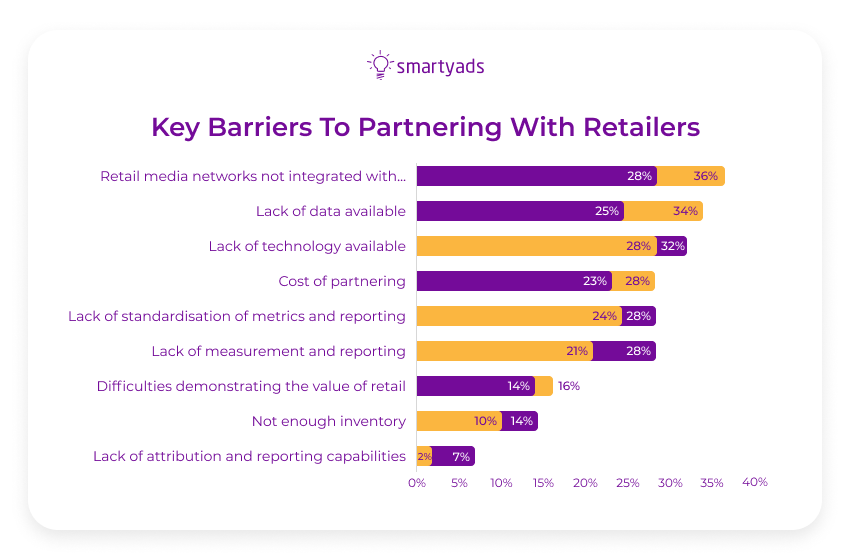

But there are still certain barriers to partnering with retailers:

Also, retail media is expected to standardize metrics and reporting.

Integration with Third-Party Advertising Technology Platforms DSP/SSP

Retail media is one of the essential categories for programmatic. But the main pain points of media are scale and technology. Due to their size, the most prominent retailers are developing their own advertising technology based on first-party cookies.

The Value Of Programmatic

Programmatic advertising is valuable because it uses technology, analytics, and user data to automate advertising. This means saving time and effort in authorizing new customers and buying and selling ad spots on their platform. And this automation is also helpful for advertisers, who are accustomed to getting their message across to potential customers in a practical, programmatic, and real-time way.

But many brands also want the opportunity to purchase advertising through their adtech partners. Retail media is a relatively new advertising channel where integration with third-party technical advertising platforms is yet to come. Lack of integration is an impediment to more significant brand investments. Programmatic allows small and medium-sized businesses to compete with large companies, and that's important.

One thing is clear: retailers will partner with third-party advertising solutions or build them. Of course, only big retailers can create their solutions.

Own Programmatic Solutions

What major retailers have in common today is a concern for customer data protection. Therefore, they are cautious in selecting marketers' technologies to activate their companies on the platforms.

Some retail giants are expanding their DSPs or creating joint technology solutions in partnership with other ad tech companies. For instance, Walmart recently announced the creation of the Walmart Connect platform in partnership with advertising technology firm The Trade Desk. Walmart Connect unites brands and Walmart's customers as a demand-side platform. Amazon has begun offering programmatic ad space through Amazon Marketing Cloud.

Big retailers also already have their exclusive partners. For example, Walmart has partnered with Target Roundel's SSP associates (Index Exchange and Criteo), and Albertsons recently teamed up with The Trade Desk and Pacvue. With the DSP deals, they can also buy their inventory at bargain prices off the platform.

DSPs allow software solutions to personalize message delivery for each customer. They provide an opportunity to target clients with keywords and first-party data, such as demographic or behavioral data. In essence, it gives the opportunity to hyper-focus on customers and deeply understand their path to purchase.

For medium and small businesses, the inventory of these retail platforms will be available through SSPs, which will be connected to different DSPs or directly to bidders. SSP segments will solve the monetization problems of publishers. And the ad server will be the primary one for managing and optimizing algorithmic advertising, direct sales, and native advertising.

Integration with Third-Party DSPs

Retailers are expected to become key partners for DSP platforms after Google imposes restrictions on third-party cookies.

DSP's partnership allows retailers to activate their customers and launch campaigns for them more easily. DSPs can seriously reduce friction when they connect advertisers with such platforms, resulting in increased budgets. So, ad technology platforms, like SmartyAds DSP, support the most compelling ad formats, increasing the ROI.

Conclusion

It is expected that brands will require retailers to distance themselves from the walled garden model. Brands expect them to be free to choose the format and opportunities to integrate the platform with their advertising technology platforms and get a full picture of attribution.

To use attractive advertising formats, sign up at SmartyAds DSP.