Picture programmatic advertising as a sophisticated dance floor where CTV, mobile, and audio performers twirl under the spotlight while AI and Retail Media wait in the wings for their star turn. IAB Europe's 10th annual "Attitudes to Programmatic Advertising" report offers us front-row seats to this captivating performance—a show where quality concerns keep stealing scenes and cookie deprecation looms like a dramatic plot twist everyone sees coming but few have prepared for.

CTV takes center stage while mobile and audio find their rhythm

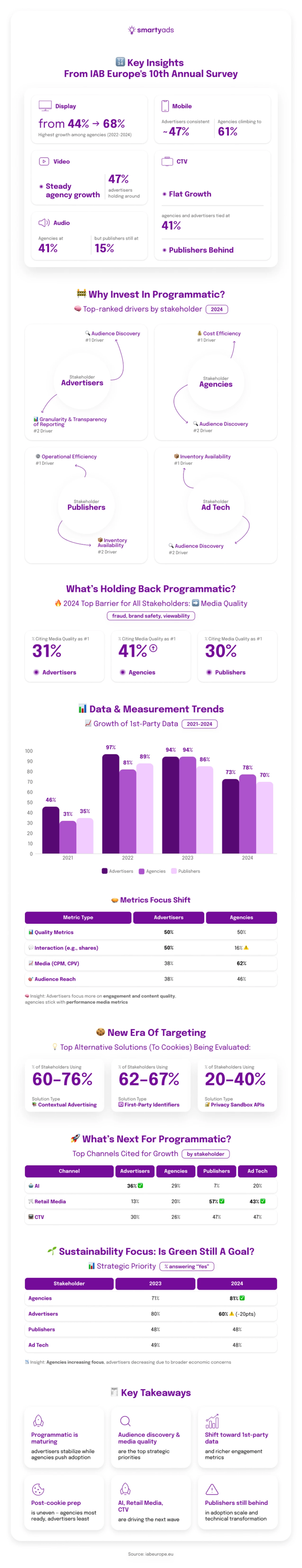

Connected TV has stepped into the spotlight with the confidence of a prima ballerina, no longer content with understudy status. The audience has noticed—40% of advertisers now direct over 41% of their CTV budgets through programmatic channels, with approximately one-third of all stakeholders pointing to CTV as the performer most likely to bring down the house in coming seasons.

Mobile, meanwhile, dances with the assured movements of a veteran performer who knows every mark on the stage. The numbers tell the story of its graceful execution: 47% of advertisers and an impressive 61% of agencies now commit more than 41% of their mobile budgets to programmatic. That 6% jump in agency investment from 2023 to 2024 suggests the choreography for mobile is becoming increasingly compelling.

And what of Audio? Think of it as the jazz improvisation in this digital performance—not always following conventional patterns but creating something uniquely engaging. While only 21% of advertisers currently give Audio significant programmatic applause, publishers have ranked it as their favorite performer to watch. This curious disconnect between those who create the content and those who fund it hints at untapped harmonies waiting to be explored.

The quality quest: everyone's standing ovation or collective headache?

If this year's programmatic performance had a recurring motif, it would be the pursuit of quality. In a plot development that has united our sometimes-fragmented industry, "quality of media" emerged as the primary concern for all stakeholders—31% of advertisers, 41% of agencies, and 30% of publishers all pointed to this as their central worry.

Imagine the entire audience at our programmatic theater suddenly focusing on the same detail in the performance. This shared attention represents a significant shift from previous seasons when different groups were distracted by various concerns—costs, sustainability, or economic factors. Now, all eyes scrutinize the same aspects: Is this performance authentic? Is it visible to the right audience? Is it appearing in appropriate venues?

As one industry critic noted in the report: "Despite advancements in technology and data analytics, concerns surrounding brand safety, ad fraud, and viewability persist, impeding the confidence of advertisers." The spotlight on quality burns brighter than ever, suggesting our industry's technological solutions haven't yet mastered this essential choreography.

The cookie farewell tour: not going to happen?

No discussion of digital advertising would be complete without acknowledging the long, drawn-out farewell tour of third-party cookies. Like a beloved but controversial band announcing their retirement years in advance, cookies have been saying goodbye while many fans seem uncertain whether the final concert will actually happen. Read more about evolution of digital advertising in our previous articles.

The readiness disparity is telling: only 43% of advertisers have their backstage passes ready for the post-cookie world, while 73% of agencies and 79% of ad tech vendors claim they've been prepared for ages. This preparation gap reveals fundamentally different perspectives on the urgency of this transition.

Even more fascinating is the behavioral evidence: after significantly reducing their reliance on third-party data in 2023, most stakeholders (except publishers) increased usage in 2024. It's as if, knowing the cookies are finally about to leave the stage, everyone's grabbing one last taste before the jar is empty.

The audience appears to be hedging its bets on replacement acts. Contextual advertising (67%) and publisher-provided identifiers (60%) lead among advertisers' preferred alternatives, but the experimental mood suggests no clear headliner has emerged. It's like watching multiple opening acts, unsure which will ultimately claim the main stage.

The two main characters of those years: AI and Retail Media

Every great show introduces new talent, and this year's programmatic performance highlights two rising stars: AI and Retail Media.

AI enters the stage with dramatic flair, with 36% of advertisers and 29% of agencies believing it will command attention in future performances. Interestingly, advertisers seem more captivated by AI's potential than their agency partners—one of those rare moments when the client appears more adventurous than their advisors.

Retail Media Networks perform with the precision of dancers who know exactly where their next paycheck is coming from. Ad tech vendors particularly appreciate this clarity, with 43% naming Retail Media as the premier growth driver. The ability to connect advertising directly to purchase behavior creates choreography that feels both innovative and reassuringly measurable.

Meanwhile, the dance between advertisers and agencies continues its traditional patterns with some new moves: 44% of advertisers still primarily partner with agencies for programmatic execution, yet 42% are considering bringing these movements in-house within the next year. This push-pull between control and collaboration remains one of advertising's eternal dances.

Sustainability: the beautiful movement some audiences are no longer watching

If sustainability were a dance in our programmatic performance, it would be a meaningful but increasingly less-attended show. While over 80% of agencies consider sustainable programmatic a must-see (up 10 points from 2023), only 60% of advertisers still hold tickets—a 20-point decrease that hints at shifting priorities under economic pressure.

The perception gap grows even wider when discussing progress: nearly 70% of agencies believe meaningful steps have been taken toward Ad Net Zero goals, while a mere 20% of advertisers see the same performance. It's as if they're watching entirely different shows, raising questions about how we measure success in sustainability efforts.

This misalignment creates an interesting tension in the programmatic theater—a reminder that even as technical capabilities advance, values and priorities can move in different directions.

To help visualize these shifts across CTV, mobile, audio, quality concerns, and sustainability, we've summarized key findings from the IAB Europe report in the infographic below. It highlights where different stakeholders stand—and stumble—on the programmatic stage in 2024.

Choreographing success in the programmatic ballet

For brands and agencies working to perfect their programmatic dance moves, partnering with the right instructor has never been more crucial. The ideal DSP platform serves as both choreographer and stage manager, helping to transform industry challenges into breakthrough performances:

- Premium Venue Access: Direct relationships with publishers across CTV, mobile, and audio ensure your performance reaches quality audiences in prestigious, brand-safe venues.

- Quality Assurance: With the entire industry focused on quality concerns, rigorous fraud prevention and viewability measurements have become as essential as proper lighting in a theater—they make the entire performance visible and authentic.

- Identity Innovation: While only 43% of advertisers feel ready for the post-cookie world, the right partner provides both traditional and cutting-edge identification techniques to ensure your performance connects with the right audience, regardless of how identification evolves.

- Emerging Stage Expertise: DOOH represents an exciting new venue, with the potential to showcase brands in high-visibility environments. Though only 13% of advertisers currently direct significant investments to programmatic DOOH, interest continues to grow in this immersive format.

- Transparent Production Values: Working with partners who operate their own SSP provides unique visibility into how the programmatic stage is constructed and priced, addressing the transparency concerns highlighted throughout the report.

Final act: the show must evolve

The programmatic landscape resembles a theater constantly renovating itself while performances continue uninterrupted. CTV commands attention from center stage, mobile executes its moves with practiced precision, and audio creates intriguing harmonies in the background. Meanwhile, AI and retail media rehearse eagerly in the wings.

Quality concerns unite our audience in a way few other issues have managed, while cookie deprecation creates a narrative tension that influences every other aspect of the performance. Sustainability, once seemingly central to the story, now plays a supporting role with varying importance depending on who's watching.

The most successful players in this evolving production will be those who embrace innovation while mastering the fundamentals—who explore the creative potential of AI and retail media while addressing quality concerns and preparing thoughtfully for privacy-centric identification methods.

By partnering with platforms that provide direct publisher connections, transparent measurement, and adaptable targeting solutions, brands can move through this complex choreography with both technical precision and creative expression. As IAB Europe's decade of data demonstrates, programmatic advertising isn't just changing its dance steps—it's creating entirely new forms of movement where quality, creativity, and performance metrics dance in harmonious balance.

To move in sync with this transformation, consider a DSP like SmartyAds—built for agile, transparent, and future-ready programmatic.