The model of the second-price sealed-bid auction has been a staple for quite some time, and it has garnered considerable focus regarding its development in recent years. Although there has been considerable talk about moving towards first-price auctions, the second-price auction framework continues to be popular among buyers and sellers around the world. Despite Google's initial intentions to shift to first-price auctions, they have opted not to completely phase out second-price auctions. As a result, numerous publishers and advertisers have started to employ a mixed approach, leveraging both types of auction models to refine their tactics.

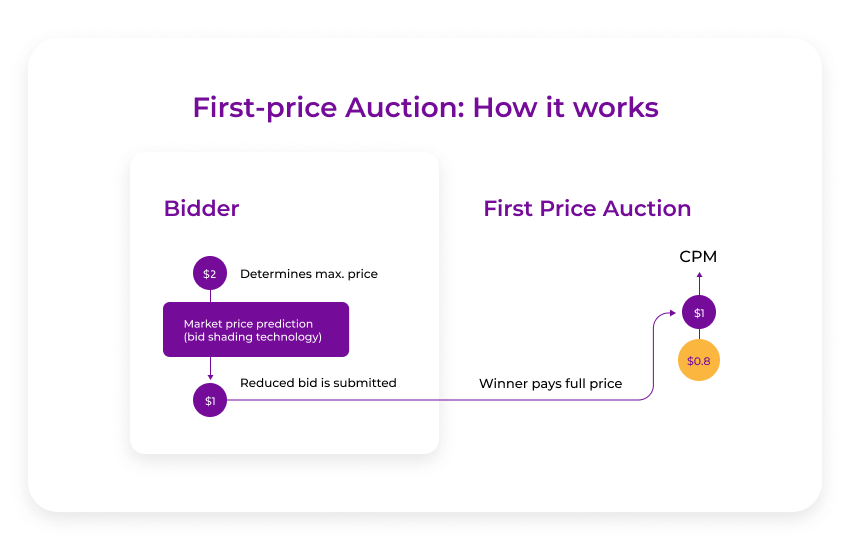

What is a First-Price Auction?

In a 1st price auction, the competition heats up as participants vie for the win by offering the highest bid. The twist? The winner shells out exactly what they pledged, sparking a more calculated approach to bidding.

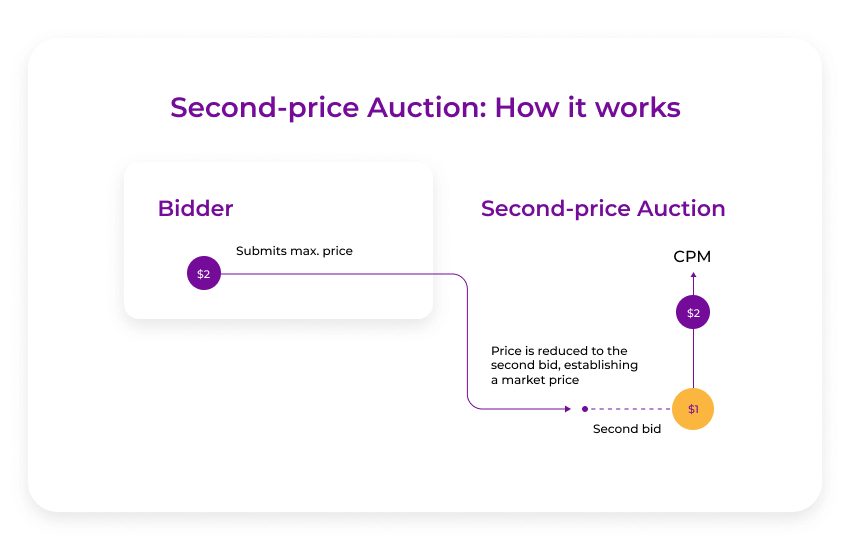

What is a Second-Price Auction?

A 2nd price auction is an interesting approach to bidding where the person who offers the highest amount actually ends up paying the price offered by the second-highest bidder. This encourages participants to bid more genuinely since they know they won't have to pay the top price they bid if they win.

Second-price auction: how it works

Let's look at a second-price auction example to make it easier to understand. Picture a scenario where there's an online auction happening in real time for an ad space. We have three participants in this bidding war: let's call them X, Y, and Z. X decides to bid 50 cents, Y goes a bit higher at $1, but Z tops them all with a $2 bid. Now, in most auctions, you'd think Z has to cough up the full $2, right? But here's the twist: because it's a second-price auction, Z only has to pay a tiny bit more than what Y offered — so Z wins the auction but pays just $1.01. It's like getting the best of both worlds: winning without breaking the bank!

First-price auction: how it works

In first-price auctions, the process is more straightforward. When buyer X offers $0.5, buyer Y proposes $1, and buyer Z bids $2, the opportunity is awarded to the bidder with the "highest offer," which in this case is bidder Z. Yet, within a first-price auction programmatic advertising, buyer Z would be required to pay the precise amount they bid, which is $2 unless bid shading is utilized to adjust the discrepancy.

First-price vs. second-price auction

The distinction between a generalized first-price auction and a second-price auction lies in the payment method of the winning bid. This variance necessitates tailored bidding strategies to navigate each scenario effectively, as suggested by game theory principles.

| Difference between first and second-price auctions | ||||

| Type | Description | Private-value auction profitability.(risk-neutral bidders). | Private-value auction profitability.(risk-averse bidders). | Common-value auction profitability. |

| first-price | Bidders submit sealed-bids. The winner pays the submitted price. | Same profitability as other auction types. | Most profitable because bidders pay close to reservation price. | Less profitable as bidders are concerned with the winner’s curse. |

| second-price | Bidders submit sealed-bids. The winner pays the second highest bid submitted. | Same profitability as other auction types. | No effect on bids, same profitability. | More profitable than the first-price auction. |

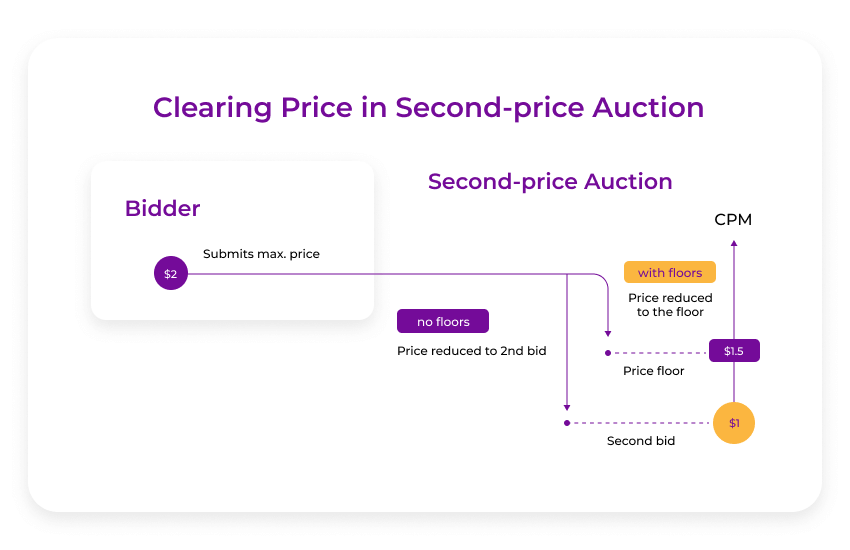

In any trading, including those on real-time bidding platforms, the sellers are interested in receiving the highest price, and the buyers are interested in paying less. The point where the mutually acceptable agreement happens is called a ‘clearing price’, which is different in various auctions, including the 1st price vs 2nd price auction. The clearing price for the 2nd price auction is interesting. In a second-price auction, the winner is supposed to pay the cost of a second winner or the price floor established by the publisher (depending on which price is higher). The gap between these two can reach 50%, but the limit defined for such situations helps to restore a particular share of money.

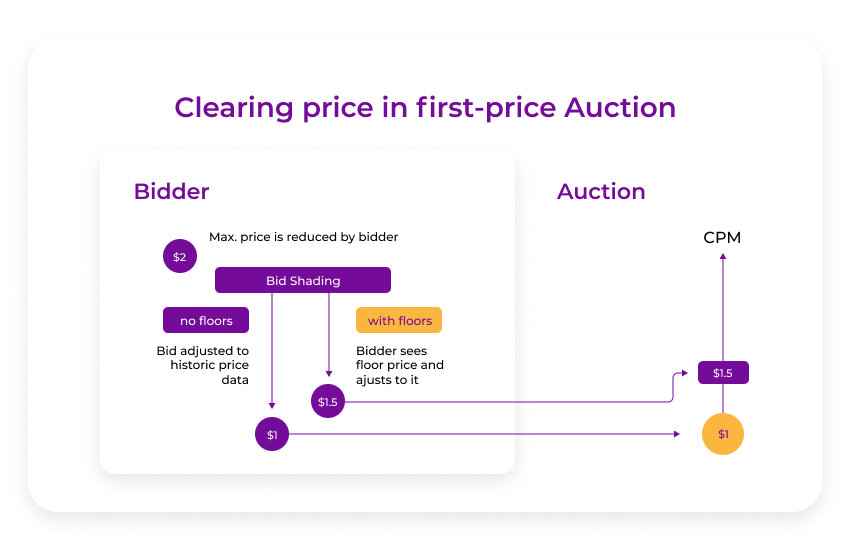

In a first-price auction setting, the minimum bids don't directly sway the final auction prices. Yet, they do play a role in shaping how bidders strategize. With this auction model, advertisers can't influence the top bid since it won't simply fall to the second-highest offer. To avoid situations where advertisers might end up paying too much, the initial bid is adjusted down to a more reasonable level, which is less than the absolute maximum a buyer might be willing to pay. This encourages bidders to think carefully about their maximum bid and consider setting it slightly lower based on their estimation of the second-highest bid. This strategy, known in the advertising technology sector as 'bid shading,' has become quite popular for its effectiveness in optimizing bid prices.

Why the Transition From Second- to First-Price Auctions?

From the beginning of programmatic advertising, the advertising technology industry has mainly utilized second-price auctions, with platforms such as Google Ad Manager and Ad Exchange being prime examples. This model was initially considered superior from a technical standpoint as it promoted transparent bidding. Nonetheless, as the system grew more complex, it became increasingly difficult to comprehend. By 2022, both advertisers and publishers found themselves grappling with the challenge of accurately assessing inventory value in programmatic auctions.

“This confusion results in a situation where advertisers and publishers fail to understand the true value of the inventory sold programmatically,” explains Sam Cox, Group Product Manager at Google Ad Manager. As programmatic models became more intricate, managing the operational complexities grew difficult, leading to uncertainty about whether auction strategies were optimized.

By 2023, many players in the ad industry began shifting toward first-price auctions for greater transparency and simplicity. First-price auctions eliminate much of the complexity, making the revenue distribution process clearer and easier to manage. According to recent reports from the IAB, the first-price model has been the preferred choice for header-bidding auctions since 2017, and its adoption has only grown in recent years, particularly in the U.S. and APAC. This trend reflects the industry's move toward simplification and transparency, aligning with advertisers' demands for more predictable outcomes.

What First-Price Auctions Mean for the Publisher

Earning More Without Compromise

Publishers are seeing a boost in their earnings without having to settle for less. The key? Advertisers are paying what they promise in their bids, ensuring that revenue isn’t watered down.

Clear as Day Pricing

It’s become easier for publishers to really understand what their ad space is worth. This clarity allows them to fine-tune their pricing strategies to get the most out of their inventory.

Keeping It Simple

Gone are the days of headache-inducing auction models. First-price auctions have streamlined the whole process, making it simpler to understand where the money’s coming from.

A Magnet for Advertisers

Thanks to the transparency and straightforwardness of first-price auctions, more advertisers are jumping into the fray. This uptick in interest means a more competitive environment for ad spaces.

More Power Over Pricing

Publishers now have a stronger hand when it comes to setting floor prices. This means they can better ensure their bids never dip below a certain profitability threshold.

The Growing Appeal of First-Price Auctions

In recent times, first-price auctions have really taken off, especially when it comes to header-bidding, which includes both mobile and in-app contexts. Industry insights reveal a notable swing towards this model for header-bidding deals, marking a significant shift in preference. This trend isn’t just confined to one area; it’s particularly pronounced in the APAC regions, where the promise of maximizing revenue has made first-price auctions increasingly popular.

First-price auctions make the most sense when advertisers understand the true market value of impressions and the soft and hard floor prices set by publishers. As the industry evolves, both buyers and sellers will need to adjust their pricing strategies to stay competitive. Publishers and app developers may need to re-evaluate their use of floor prices and reassess which demand partners will best support their goals in a changing auction landscape.

What First-Price Auctions Mean for the Advertiser

The use of first-price auctions has a significant impact on how advertisers formulate their bidding strategies. In this model, advertisers are required to bid the precise amount they are willing to pay for an impression, which results in several important implications:

Increased bidding transparency

Advertisers have a clearer understanding of the final cost of their bids, making it easier to budget and strategize effectively.

Competitive bidding environment

With advertisers paying their full bid amount, the competition intensifies, prompting advertisers to carefully assess the value of the inventory and bid accordingly.

Encouragement of honest bidding

Since the auction model eliminates the possibility of “gaming” the system through lower bids, advertisers are more likely to submit honest bids that reflect the true value of the impressions they seek.

Better inventory valuation

First-price auctions compel advertisers to gain a deeper understanding of the market and the specific value of the ad inventory they are targeting, fostering more informed decisions.

Adaptation to pricing dynamics

Advertisers may need to adjust their strategies to account for the direct relationship between bid prices and auction outcomes, leading to more strategic bidding based on performance metrics.

How to choose a price auction model?

As the AdTech market is in the middle of a transformation, it is recommended to run several tests in order to determine the best working auction you need to apply on the demand-side platform or supply-side platform.

So far, there’s no evidence that the second-price sealed bid auction is moving away; still, as the market moves to the first-price sealed bid auction model, many publishers reconsider how they set the floor prices. Today, many publishers are trying to minimize the revenue gap between the floor and the clearing price. As a product of this, we witnessed the rise of the soft and hard price floors that turned the auction model into a hybrid.

Since October 2017, SmartyAds has been a part of the Rubicon Project initiative that supports first-price programmatic auctions. We strongly believe that first-price auctions create a fairer and more transparent programmatic ecosystem, increase the bidder’s reliability, and empower a more trustworthy environment for demand and supply partners.

We give our partners time to adjust to the new auction strategy and choose an auction model that works best for them. As a part of the transition stage, we offer SmartyAds Dual Auction® empowered by machine learning that caters to both first- and second-price auctions.

"SmartyAds offers both auction models to its clients. Best-performing ads, premium placements, and top ad formats would be presented at first-price auctions, and the rest of inventory will go to the old-school second-price auctions. We don’t want to rush our clients to shift to a new auction model. We let them see how both models work, compare and make conclusions. AI will be a huge part of this transition, and we want our clients to get used to the machines making decisions.", says Ivan Guzenko, SmartyAds CEO.

The takeaway

As the industry shifts toward first-price auctions, it's important to recognize that second-price auctions will continue to exist. However, the role of price floors is likely to evolve, redistributing income in ways that can enhance publishers’ ability to attract better yields. First-price auctions provide advertisers with a clearer understanding of auction dynamics, helping to eliminate confusion and enabling more strategic bidding.

Publishers and advertisers should prioritize implementing reliable processes and technologies to continuously evaluate and optimize their cost-per-thousand impressions (CPM) results. SmartyAds’ Dual Auction® model exemplifies this evolution by offering both first-price and second-price auction programmatic options. Since the introduction of this model, SmartyAds has provided clear signals to bidders regarding which type of auction they are participating in — either first-price or second-price. This hybrid approach allows bidders the flexibility to choose the auction model that best fits their strategy. We encourage our clients to test various auction types, including first-price, second-price, and dual-price models. By exploring these different auction frameworks, advertisers and publishers can gain valuable insights into which approach yields higher revenues and greater value for their businesses.

Get an opportunity to trade in various types of auctions anytime! Contact us to find out more!