If you've recently started delving into the "video on demand" or "VOD" niche as an advertiser or publisher, you may have encountered several unfamiliar terms. To master monetization in this environment, you need to understand concepts like AVOD, SVOD, and TVOD.

Each of these abbreviations relates to a specific monetization method of video content on demand. Particularly, this subject is very close to connected TV advertising. Choosing the right strategy for your needs is the first step to ensuring the success of your advertising or monetization efforts.

Today, we're going to delve into all of these concepts, with a particular focus on TVOD, to help you make the right choice so that you can enhance your future advertising campaigns with the right type of traffic.

What does TVOD stand for?

First of all, let’s deconstruct TVOD meaning word by word.

Transactional video on demand refers to the monetization of video content that implies paying per view instead of the common subscription model, when the user pays every month and watches the content as much as needed.

In other words, users are granted access to view a piece of content for a limited time by renting it. We will review forms and subtypes of TVOD further in detail.

Now, let’s try to understand what is TVOD in simple terms. It is like renting a bike — you can rent it for a month and use it as much as you desire. Alternatively, one can rent it for a couple of hours, which will be a wise decision in case you are sure that you won’t need it tomorrow. This way, users don’t overpay for something they won’t be using or consuming.

What is prime video TVOD, then? Examples include Amazon Prime Video where users can rent or purchase individual titles on a pay-per-view basis.

Evolution of TVOD

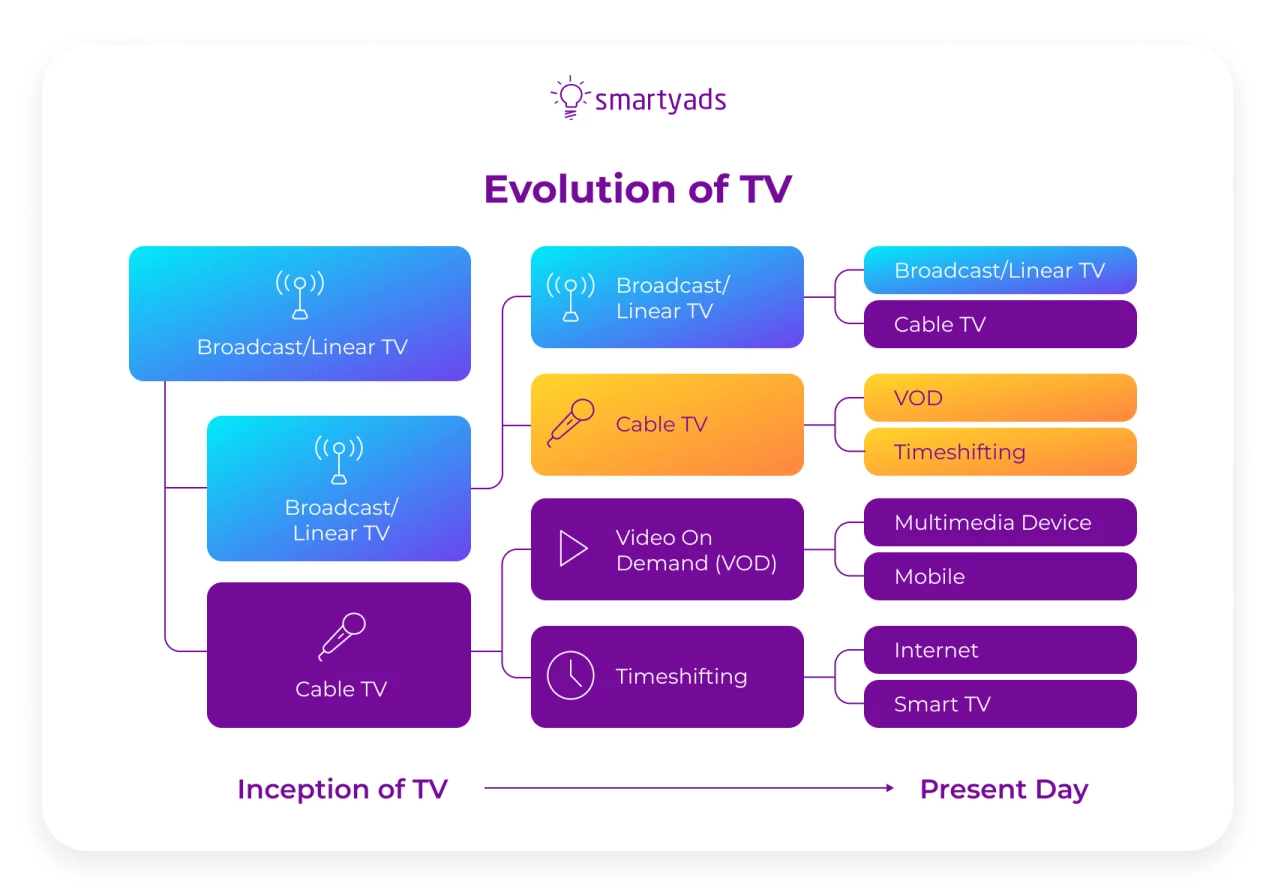

The evolution of TVOD traces back to the dawn of connected and over-the-top television, the time when video content consumption was no longer dependent on broadcasting. With Internet-powered devices, people started consuming TV shows and other types of video content on demand.

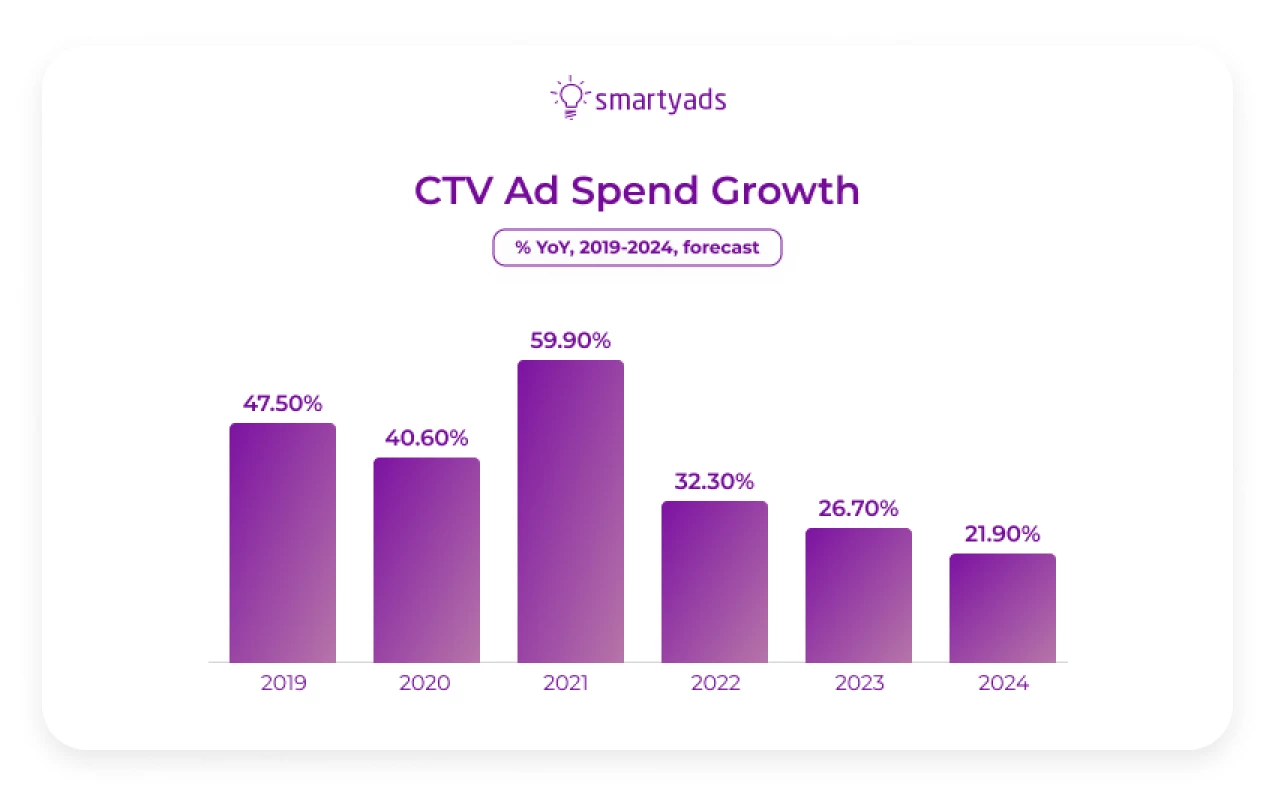

Now, TVOD makes a huge part of the OTT niche, generating no less than $10 billion in revenues every year. Thanks to the proliferation of VOD content monetization, content owners gained yet another convenient way to capitalize on their efforts, while users obtained a way to pay for content usage in a more flexible way. Thus, CTV ad spend grew tremendously.

In terms of transaction video on demand is very promising. For instance, with TVOD, payment for users normally ranges between $3.99 and $6.99 (for download to rent model) and $29.99 when we take transactions for the Electronic Sell-Through model.

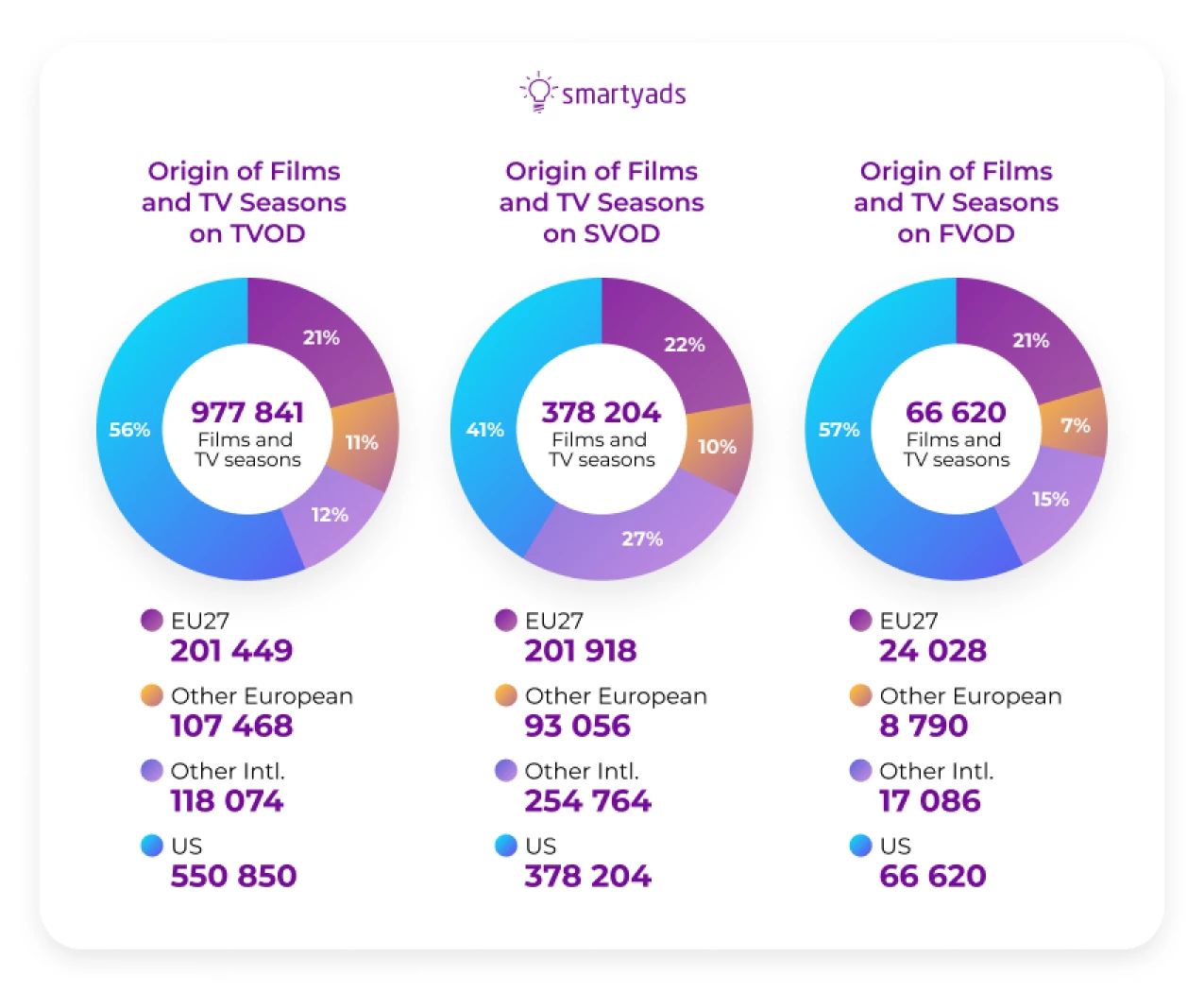

In May 2020, the average number of movies on transactional video-on-demand services was 5126, compared to 1031 on SVOD platforms. Additionally, the proportion of European movies on TVOD platforms was slightly higher than on SVOD, at 31% versus 29% respectively. Among the 27 EU member states France emerged as the primary supplier of movies for TVOD, accounting for 30% of the total share.

This was followed by Germany (22%), Italy (9%), and Spain (7%). These countries also contributed to 66% of all content produced in the EU available in SVOD catalogs. The UK accounted for 8% of all movies available on TVOD platforms and 6% on SVOD.

How is it going to evolve in the future?

Obviously, transactional VOD is growing exponentially. When it comes to the future of this model and its development forecasts, here are numbers we have taken from Statista:

- Projected revenue in the worldwide pay-per-view market is forecasted to hit $10.93bn by 2024 by 2027.

- Notably, the United States is anticipated to lead in revenue, projecting $2,423.00m in 2024.

- The average revenue per user (ARPU) is estimated at $13.90 by 2024.

- By 2027, the user count is expected to soar to 0.9 billion.

- The user penetration rate, indicating service usage among the population, is projected to rise from 10.2% in 2024 to 10.8% by 2027.

- Despite the surge in streaming platforms, pay-per-view will remain a preferred choice in various countries, notably the United States.

Comparison with other models

There are several main types of payment for video on demand. Sometimes, these models are encountered in pure form, but more often, two or three of them are combined. As we’ve already familiarized ourselves with the TVOD definition, it’s time to review and compare the other models.

- FVoD (Free Video on Demand): content on demand is provided to subscribers for free and without displaying ads.

- SVoD (Subscription Video on Demand): users get access to content by subscription (payment once a month/quarter/year).

- AVoD (Advertising Video on Demand): the user pays nothing for viewing content, but the video is accompanied by the display of advertising clips, the display of which is paid for by advertisers to the operator. This type of video service monetization is the most common.

- PVoD (Premium Video on Demand) — a type of TVOD where users can pay for early access to new content.

We’ve reviewed prime video TVOD meaning before. Now it’s time to find out what additional categories the TVOD model can be divided into:

- EST (Electronic Sell-Through): the client acquires long-term access to content (usually no more than 5 years).

- DTR (Download to Rent): The user pays a fee to be able to stream one taken content unit for a particular time (normally one day or two).

Below is a comparison table of these models:

| Payment Model | Description | Pros | Cons |

| FVoD (Free VoD) | Content is provided to subscribers for free and without displaying ads | Free for users | Limited revenue for operators |

| SVoD (Subscription VoD) | Users get access to content by subscription, paying once a month/quarter/year | Predictable revenue stream | Limited access to users who don't want to commit to subscriptions |

| AVoD (Advertising VoD) | Users pay nothing for viewing content, but ads accompany the video, paid for by advertisers | Free for users, potential for high revenue through ad placements | User experience may be disrupted by ads |

| TVOD (Transaction VoD) | Users pay for specific content, such as a single season of a series | Allows users to pay only for what they watch, flexibility in content selection | Requires users to pay for each piece of content, potential for high costs for users |

| PVoD (Premium VoD) | Users can pay for early access to new content, similar to TVOD but with a premium price for exclusive content | Offers exclusive and early access to content, potential for higher revenue | Limited availability of premium content, may not appeal to all users |

Technically, you can find plenty of information on the web to compare these models. However, it is also worth noting that there are specifics of the market one should take into account when tapping into the niche.

For instance, according to the report we’ve mentioned before, typically, SVOD platforms host newer series, mostly not older than five years old. Normally, SVOD platforms offer a wider range of series, while TVOD catalogs contain a higher proportion of European productions.

Germany, France, Spain, and Italy are the main producers of European television content among EU member states, accounting for 75% of all productions. Seasons of German series dominate the overall TV content produced in the EU and published on TVOD services, while France is the main producer of TV content on SVOD platforms among EU members.

European VOD services offer tons of television content, with the majority available on SVOD platforms. What is TVOD prime video in this landscape, then? What place does it occupy? National VOD services offer more European content, especially on TVOD platforms. International platforms predominantly focus on content from the USA.

In case you are reviewing other options, there are also a couple of things to consider:

- FVoD is commonly popular in regions where there is a strong emphasis on providing free access to content without advertisements. It's often seen in North America, Europe, and parts of Asia, where streaming services offer a mix of free and subscription-based content.

- AVoD is prevalent in regions where advertisers are willing to invest in digital advertising, and consumers are accustomed to watching ads in exchange for free content. This model is particularly popular in North America, Europe, and parts of Asia, including the United States, United Kingdom, France, and South Korea.

- PVOD models are often popular in regions with a strong demand for early access to new and exclusive content — North America, Europe, and parts of Asia, where consumers are willing to pay a premium for immediate access to the latest releases.

Benefits of transactional video-on-demand

As was mentioned earlier, the main benefit of this model is the convenience that it gives the user in terms of payment, as a common subscription might not be so useful for users in certain cases. There are a lot of instances when users may benefit more from one-time content buying. For example, a user might realize that they don’t use Netflix on a regular basis, but there’s a strong need to access a particular show once in a while. This allows a content provider to have additional monetization opportunities. Let’s take a look at some of the benefits this model can provide to advertisers and publishers:

Exclusive audiences

The primary audience for this model consists of users who seldom switch on their television sets and are very selective about the content they consume. Such viewers are reluctant to commit to a monthly payment for the content they may not ultimately watch.

Higher user engagement and better targeting (cookieless included)

Such services typically acquire rights to new blockbusters before the content becomes available on SVOD platforms. This exclusivity is important for viewers who appreciate access to exclusive content. It means that users are explicitly looking for a particular show, which makes it possible for advertisers to place relevant ads in such videos. In the cookieless world, it gives more opportunities to advertisers who want to target effectively. The more relevant ads will be, the more likely the users will convert.

Higher revenue for publishers

This model enables publishers to capitalize on additional sources of income. With this, as we’ve mentioned above in the stats, TVOD payment for users normally ranges between $3.99 and $6.99. Renting one movie for the user means paying less from a short-term perspective, and at the same time, in the long run, it will convert into higher revenues for the publisher.

Better control over monetization

For publishers, such a model gives more freedom in defining pricing strategies and makes them more flexible for users. The more options users have to pay for content, the higher the likeability of paying.

Content strategy for TVOD

There are different strategies that can be used to attract and retain viewers while providing monetization opportunities for publishers.

Exclusive Releases:

TVOD platforms can differentiate themselves by securing exclusive rights to high-demand content, such as new blockbuster movies or popular TV series. Offering exclusive releases incentivizes users to visit the platform and pay for access to content they can't find elsewhere. This strategy creates a sense of urgency and exclusivity, driving sales and engagement.

Niche Content:

Catering to specific audience interests with niche content can help publishers in this niche carve out a dedicated user base. By offering a diverse range of content across genres, languages, and cultural interests, platforms can appeal to underserved audiences and capture their loyalty. Investing in niche content can also help platforms stand out in a crowded market and attract viewers seeking specialized content experiences.

Partnerships:

Collaborating with content creators, studios, distributors, and other industry players can enhance the content offerings of TVOD platforms. Partnerships allow platforms to access a wider array of content, including exclusive releases and premium titles. Additionally, strategic partnerships can help platforms reach new audiences, expand their content library, and drive revenue through revenue-sharing agreements.

Content creators can leverage TVOD platforms to monetize their work differently thanks to:

Direct Sales:

TVOD platforms enable content creators to directly sell their content to viewers on a pay-per-view or pay-per-download basis. Creators retain control over pricing and distribution, allowing them to maximize revenue from each transaction. By offering their content on TVOD platforms, creators can reach a global audience and generate income from individual sales.

Revenue Sharing:

Many TVOD platforms offer revenue-sharing agreements, where content creators receive a percentage of the revenue generated from each sale or rental of their content. This model incentivizes creators to produce high-quality content and promotes collaboration between creators and platforms. Revenue-sharing arrangements can vary based on factors such as viewership, pricing, and exclusivity.

Licensing Deals:

Publishers can organize licensing deals with platforms to distribute their content to a wider audience. Licensing agreements provide creators with upfront payments or ongoing royalties in exchange for granting platforms the rights to stream or sell their content. By licensing their content to TVOD platforms, creators can increase their visibility, generate income, and expand their audience reach.

Consider SmartyAds, your trusted partner

SmartyAds offers a variety of options when it comes to traffic across top-tier countries. For advertisers, it means that they can access global CTV and mobile inventory across niches and categories they need by simply registering on the SmartyAds demand-side platform and launching ad campaigns.

This way, for instance, Polina LLC, a private mobile app developer, transitioned to SmartyAds DSP in pursuit of a secure and cost-effective advertising environment and achieved excellent results. Find more information on the case study page.

With over a decade of experience in programmatic, SmartyAds has created a robust infrastructure of solutions that also provide unparalleled monetization possibilities for publishers on the SmartyAds supply-side platform.

Publisher? Advertiser or independent ad tech business? SmartyAds has solutions for everyone, be sure to ask us how we can elevate your business.

Wrapping it up

As we’ve discovered TVOD definition and functionality while comparing it with other payment models, it will become easier for you to choose what option is better for monetizing or advertising. Of course, you can always consider the option of combining your SVOD strategy with TVOD services, AVOD and more to maximize yields as a publisher. If you are an advertiser, then be sure to place your ads only on the proven inventory that drives good quality targeted traffic.

Advertise on SmartyAds DSP to access the best CTV traffic across channels. Publisher? Tap into SmartyAds SSP to reap the benefits of smart monetization.