The financial services industry will always be relevant, so financial advertising remains an essential part of the work for financial institutions and corporations. As digital technology advances, it's not too difficult to stay in the loop, especially if you use programmatic and the opportunities it presents.

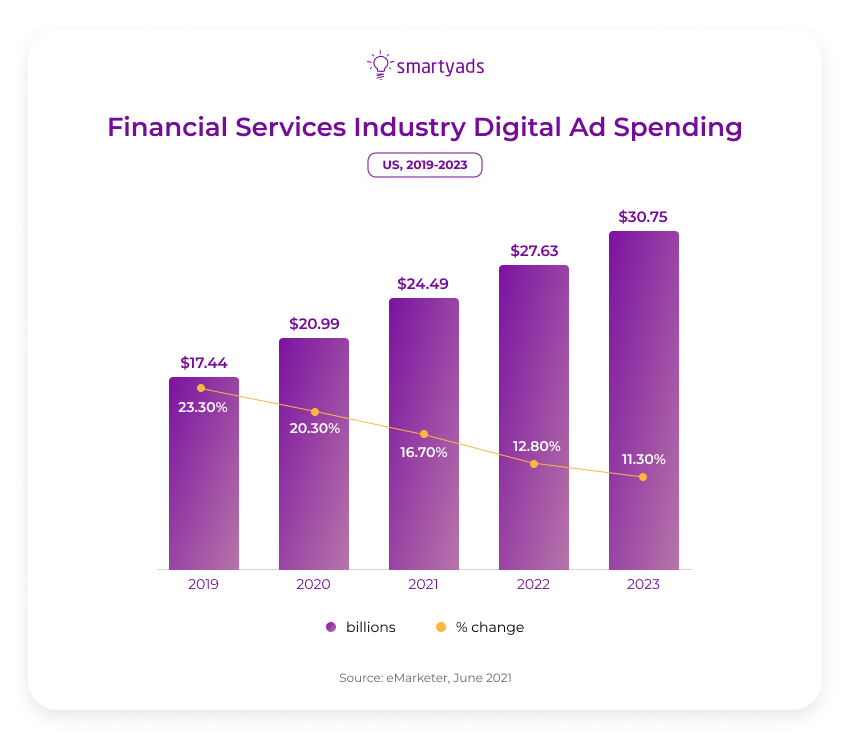

The following chart shows that digital ad spending in the U.S. financial services industry is growing: eMarketer expects U.S. digital ad buyers to spend about $30.75 billion in 2023, representing 12.3% of total digital ad spending in the United States.

What is financial advertising?

Financial services advertising refers to the promotion of financial services, including financial institutions, insurance, digital or traditional banking, brokerage, investments, or securities.

Whether we're talking about traditional advertising on television, radio, and print, or digital advertising, which includes search engine ads, direct mail promotion, and social media ads, its primary purpose is to get consumers to act.

This is a sure way to positively impact your financial sector business, which can lead to increased brand awareness, increased sales, or some other goal.

Financial services marketing tendencies

Financial services marketing strategy is essential nowadays. It also plays a prominent role in the future of many brands. The company or business should craft it timely to capture the market.

Whether it's fintech, traditional banking, commerce, insurance, or something innovative, the global pandemic is forcing marketing teams in the finance sector to adapt and enhance their marketing efforts.

In this section, we'll discuss financial services marketing tactics that a business can use to create better financial services advertising campaigns:

- Creating relevant content;

- Using short videos;

- Personalizing Financial Advertising;

- Artificial Intelligence Analytics;

- Multi-channel marketing.

1. Creating relevant content

Brands are increasingly recognizing the power of content marketing and using it to benefit their customers. While content is often used to generate organic and advertising traffic, it can also allow you to become an expert in your subject matter, which is critical to increasing loyalty to your brand.

Blog posts, podcasts, reports, ebooks, case studies, and financial accounting apps are a few examples of valuable content you can provide to your audience.

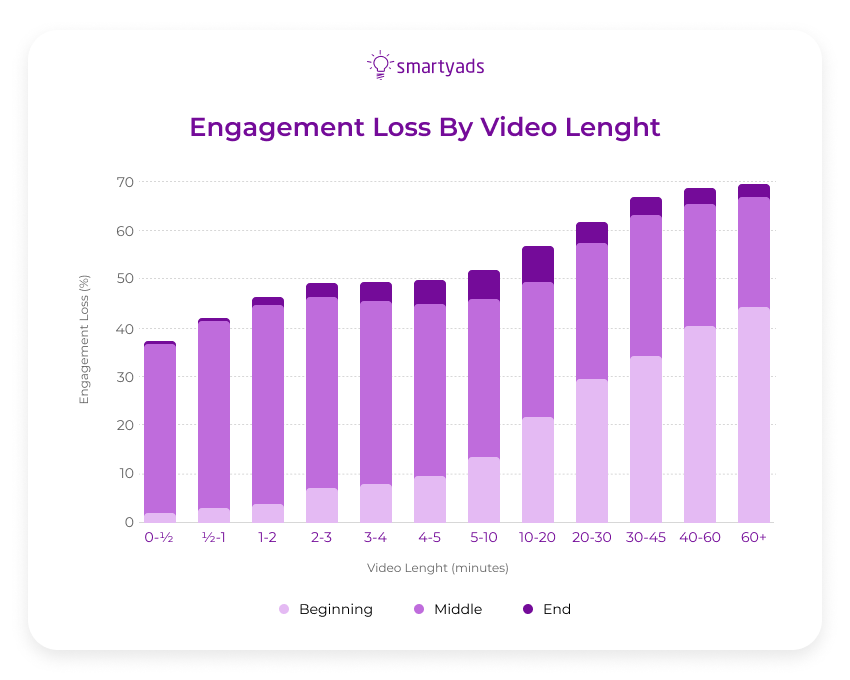

2. Using short videos

The popularity of TikTok has been plaguing marketers for several years now. Every year, this initially small social network grows, devouring attention and popularity among users. What could be more obvious proof that short videos are a suitable format for delivering information to the user? The question is rhetorical.

Great value can be found in this type of content because it can effectively deliver any message and present complex services, such as credit or insurance, concisely and engagingly.

3. Personalizing Financial Advertising

Programmatic advertising allows you to personalize your message to the customer. This means that your ads will not appeal to an abstract image of your potential customer base but specifically to the person for whom they are displayed. Well, maybe not to them, but to their alias on the Internet.

Everyone feels good when they are treated in a special way, your clients included. If you make them feel special and important to the brand, you can rapidly increase brand loyalty.

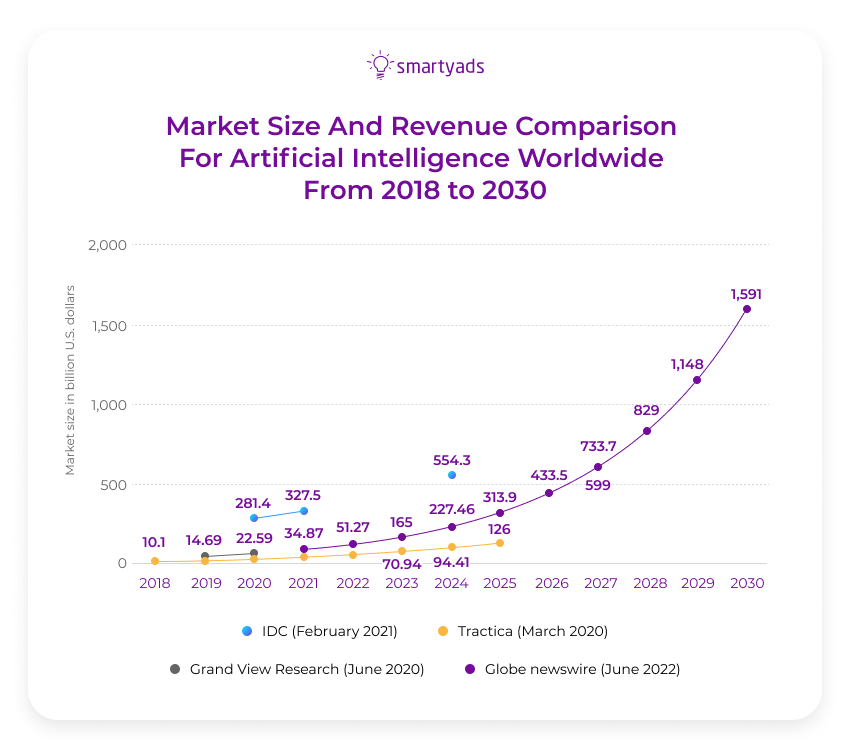

4. Artificial Intelligence Analytics

Since the very beginning of the concept of artificial intelligence and machine learning, there have been talks about the appropriateness of its use in one area or another. For digital marketing, artificial intelligence is a kind of cheat code on the basis of which you can create more accurate analytics.

The advantages of using this technology for advertising include identifying customer behavior patterns and segmenting new customers by interest or demographic characteristics for more accurate advertising targeting.

5. Multi-channel marketing campaigns

Today, a considerable part of the customer experience is produced in the digital environment, which is why many brands have focused their advertising presence on the online space.

However, a more detailed analysis shows that the offline experience has not lost its importance; in fact, it is gradually increasing with the loosening of Covid restrictions.

And it is at this point that the possibility of multiple channels of marketing campaigns that allow you to combine digital and offline platforms to display ads becomes especially important.

Effective financial services marketing strategies

Financial sector marketing needs an effective strategy to achieve specific goals. If a financial services company is going to launch an advertisement, it needs to set clear priorities in order to build its financial services marketing strategy competently.

Let's break down some working strategies for promotion in the financial services sector.

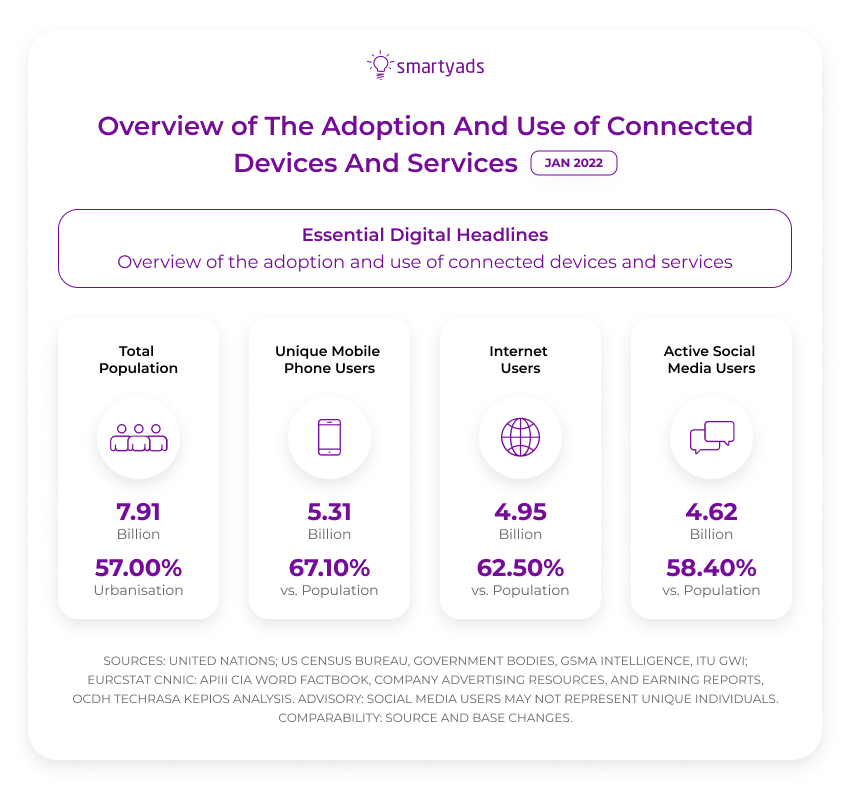

Use the power of social media platforms

62.5% of the world's population uses the Internet — the number of users for 2021 increased by 192 million (4%) and amounts to 4.95 billion people. The number of social network users grew by more than 10% and amounts to 4.62 billion — 58.4% of the total world population. Users spent online more than 12.5 trillion hours per year.

That's why you shouldn't neglect advertising on social media. Whether it's Facebook, Instagram, TikTok, or LinkedIn, there will surely be users who are a part of your target audience.

Do not focus on the presence on all possible platforms; you will simply waste your budget and achieve nothing. Analyze which social network has the most potential customers and focus your marketing efforts on it.

For example, it is well-known that generations like Boomers use Facebook more frequently than Tiktok. Many people from the senior age group also prefer communication via direct mail. Business or a company that advertises to these people should remember that each audience segment requires a different approach.

Overall, Facebook is the safest place to start advertising on social media because of the wide variety of audiences. Direct mail campaigns are also good in case your audience is prone to making email purchases.

Take advantage of programmatic advertising opportunities

Financial services marketers should not treat their consumers or potential audiences like a set of numbers on a screen. Numbers and data can be managed and moved through the sales funnel or multiplied, but numbers are not people, and behind your customer data are living, thinking individuals.

Surveys show that 56% of respondents believe most companies treat them like numbers while promoting their services. More than 73% of consumers expect companies to understand their unique needs and expectations.

The bottom line is that any personalization will work great, especially in a complex area like financial services. Let your customers know that they are more than just numbers to you.

In addition, personalization allows you to use your advertising budget more effectively, causing more conversions and loyalty to your brand.

Don't forget about SEO optimization

Not only customer trust is essential for financial services brands, but also the trust of the search engine robots that sort websites and give them priority in search result. Therefore, it's important for any financial services representative to have an SEO-friendly website. This way, your brand will catch users' eyes more often and gain credibility in their eyes.

In addition, SEO is an increase in organic, meaning conditionally free traffic, which is also more effective than advertising traffic.

Be sure to remember that Google ads traffic and organic traffic are very different, do not expect a sharp increase in visits to the website immediately after the launch of SEO.

Such optimization is a difficult and time-consuming process for which there are competent specialists, but if you describe it in one short phrase, it turns out that the relevant content solves everything. It's simple — search engine robots give a user the most accurate information possible.

This means that if a user is Googling "how credit rates work" and your website has a good, detailed article on the subject, the search engine is very likely to display it for that query.

Create valuable content in your financial services marketing strategy

The financial industry especially needs valuable content. Where else can users learn useful advice about using your financial services than from your financial brand? You can become a kind of financial advisor to your customers.

This will not only increase your audience's trust in you but also will improve your customers' financial literacy, allowing them to understand better the benefits they can get from using your financial services. It will also positively impact your website's positioning in search engine rankings.

All in all, creating valuable content is a plus. However, for some reason, many financial services need to pay more attention to this point of a successful marketing strategy.

Don't repeat after them. All marketers know the unwritten rule of advertising: content is king.

Read about COVID-19 impact on advertising and how brands handled it.

Examples of financial services company advertising

Financial products require good, creative advertising to promote them, so we have picked up some good examples of such advertising for you.

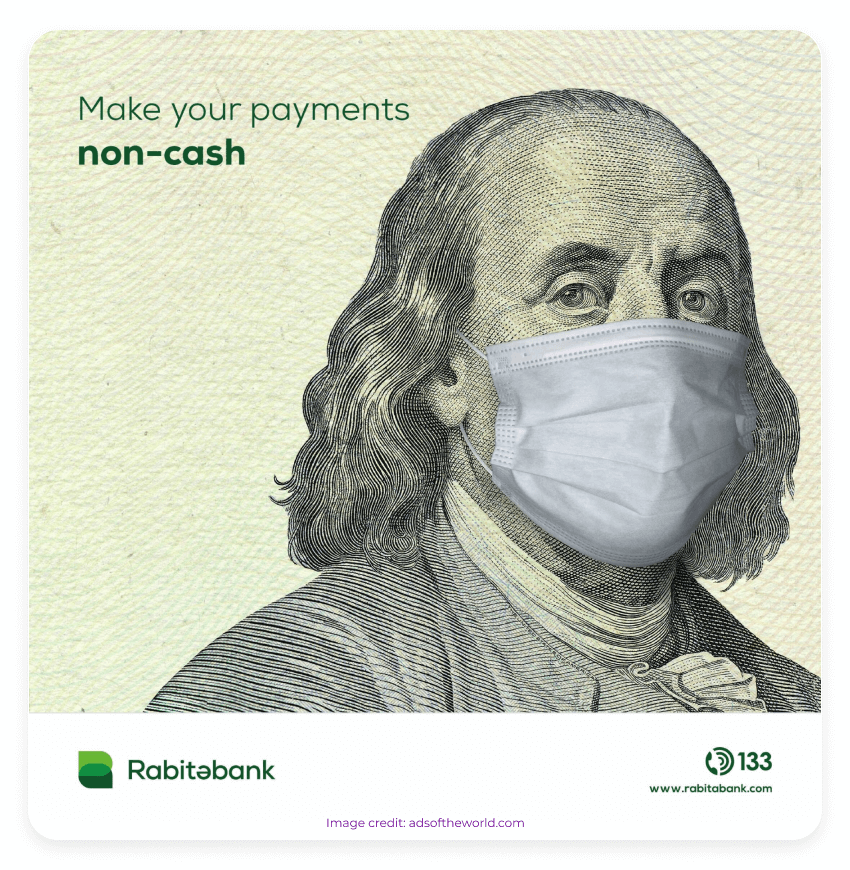

Rabitabank

At the beginning of the pandemic of Covid-19 Rabitabank published such ads:

This way, they encouraged their clients to pay by card to avoid spreading the virus through paper banknotes, and at the same time, they advertised their services.

Timely, topical, and useful to customers — that's a great example of what good financial advertising should be.

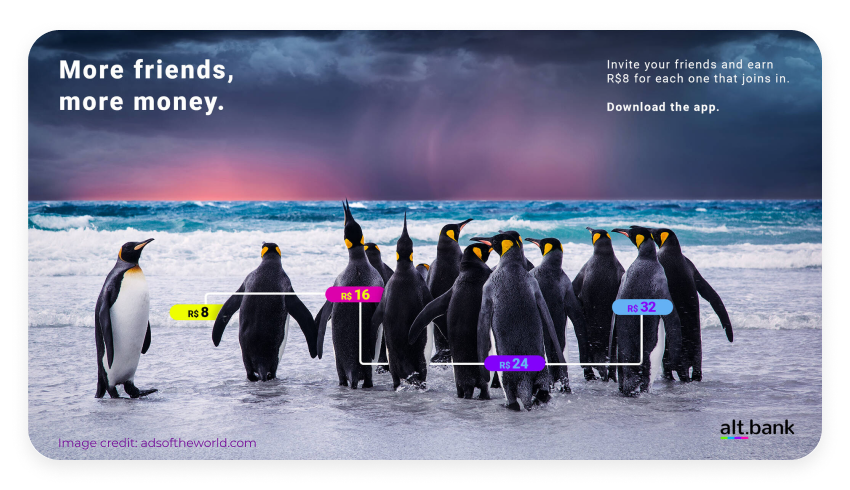

alt.bank

The digital bank alt.bank, for example, advertises a service that allows customers to get bonuses for inviting a friend:

The very idea of such a service isn't new, but in this case, it is transmitted through the display of penguins, which are known for their social cohesion (and they are also very cute).

Etoro

Speaking of cute things. Here's a cryptocurrency ad with a Shiba:

Don't underestimate the impact of positive associations with cute things! In Japan, almost every brand has a cute brand character or emoticon, and it works great.

So giving a cryptocurrency a symbol in the form of a cute (Japanese, by the way) dog is a great marketing move that can bring a lot of useful results.

Conclusions

Financial institutions and services need advertising, just like everything else you can sell or buy. Therefore, you shouldn't neglect the possibilities of online advertising or the opportunities that digital marketing offers to the financial industry.

In order to create an effective marketing strategy, it is very important for the company to study its target audience. Then marketing campaigns should be personalized to build a trusting relationship with customers. Trust is a critical component of a successful financial services business. This way, companies in the financial industry can overcome competition and become successful.

Launch a financial services advertising campaign with SmartyAds now!